Boutique entrepreneur, LLC or Corporation?

by Sebastien Mirolo on Mon, 25 Jul 2016

You are starting a Software-as-a-Service business to clinch this nagging pain

you had at the company you just left. Now swimming into the business legal

jargon, you are wondering should I create a LLC or incorporate?

I am neither a lawyer nor a certified accountant. The following blog post

cannot be construed as professional advise. It is merely the thoughts

of a boutique entrepreneur that has spent way too much time reading

through documents available on the Web. None-the-less I hope it helps you.

You are starting a Software-as-a-Service business to clinch this nagging pain

you had at the company you just left. Now swimming into the business legal

jargon, you are wondering should I create a LLC or incorporate?

I am neither a lawyer nor a certified accountant. The following blog post

cannot be construed as professional advise. It is merely the thoughts

of a boutique entrepreneur that has spent way too much time reading

through documents available on the Web. None-the-less I hope it helps you.

When should I think about a legal structure for my enterprise?

Either a LLC or a corporation will create a legal entity recognized at State and Federal levels. It comes with both benefits and costs so the first question you will ask yourself is when do the benefits outweigh the costs.

Do you have partners or co-founders?

No. Skip to the next question.

Yes. You will want a legal structure sooner rather than later. Me and my friends, we usually agree to eat at the Thai restaurant on Friday night, except last week, we got into this big argument because Donny wanted to try something new. Imagine now we own a house or a boutique enterprise together (we will use the house metaphor later on). Fights happen. Fights get ugly, especially when money is involved.

When you have multiple people involved in an enterprise, what happens under a few basic scenarios need to written down. The two main questions either a LLC or a corporation will address are:

- Who gets what when we sell the house?

- Who makes the final decision to sell (deciding vote)?

Co-founders, also known as sweat-equity investors, as opposed to financial investors, are expected to work in the business to make it more valuable over time. A few other clauses LLC membership agreements or Corporation shareholder agreements deal with are:

- Who gets what when we rent the house (monthly revenue split)?

- What if I want to stop being involved in running the business tomorrow (clawback)?

- What if I want to sell my share to a third-party (right of first offer)?

Do customers pay you?

No. Skip to the next question.

Yes. The enterprise has revenue which means taxes are owed. Even if the business is not profitable, you will still need to declare the revenue made on a tax return. A separate legal entity is a good idea. It will protect your personal assets. Who knows, an angry customers might decide to sue your enterprise. You wouldn't want to be personally liable for debts of the business entity.

Do you pay employees or contractors?

No. No partners, no customers and no people expenses? Then don't bother and come back later.

Yes. You are paying people to further your business. You need a separate legal entity. Most lawsuits against small or starting businesses are made by people very close to you. The chances a disgruntled employee sues your company is a lot higher than any customers decides to do so. Many times people invest a lot of their energy and dreams in a startup. Emotions run high. "A contract is a contract is a contract" so make sure everything is on paper and signed, preferably with a separate legal entity. You wouldn't want to be personally liable for debts of the business entity.

OK. I have partners, customers and/or employees, Should I create a LLC or incorporate then?

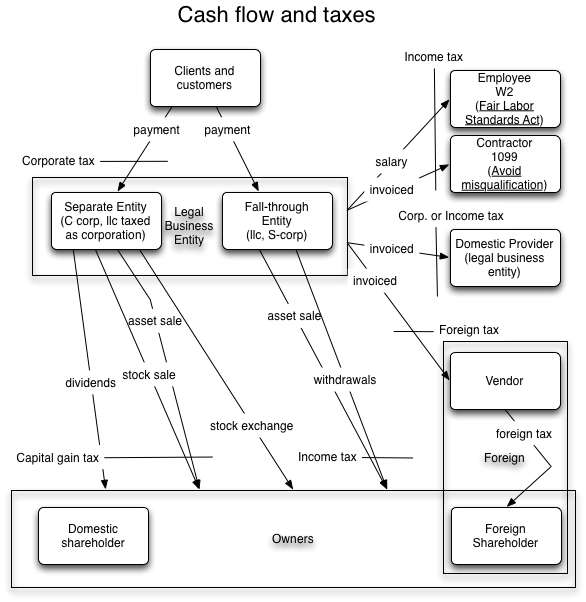

First, if you have any foreign (i.e. someone that does file a US tax return) co-founders / investors, you will need to create an entity that is taxed as a Corporation. Fall-through LLC and S-Corporation are out of the picture when you have foreign investors.

No foreign investor? Ultimately LLC vs. Corporation boils down to a choice of liquidity profile. This means:

- How easy is it to sell parts of the business to a third-party?

- How easy is it to transfer revenue to owners?

When a corporation is traded on the public stock market, anyone can sell and buy shares (i.e. parts of) the business. LLCs usually involve very restricted conditions under which one member can sell part or whole of its share. LLCs also often dissolve when membership change significantly.

LLCs are treated by default as disregarded entity (solo-entrepreneur) or partnership (multiple co-founders) for tax purposes. That means that the revenue from the business can flow through from the LLC bank account to your personal bank account with no tax consequences because no matter what, you will pay taxes for the whole business revenue on your personal income tax return. Corporations can elect to file as a S-Corporation, which will also give them a disregarded status for tax purposes, but that comes with a lot more restrictions than LLCs have there.

Corporations have two ways to pay owners, either as dividends on profits after Corporate taxes have been paid, or through a salary as an employee. Of course the owner must then pay both taxes on dividend paid and salary income. This is often referred as double taxation.

It is clear that the IRS will not stand for a nominal salary and a huge dividend at the end of the year. The difficulty then for a boutique entrepreneur is to figure out a reasonable salary based on current and future revenue projection. This can be quite difficult when you are just started and have no idea of the seasonality of your business.

If you intend keep the business under a few stable owners for a very long time, an LLC is a sound choice. If you are looking for institutional money right away, you will be required to start a Corporation.

What about Delaware?

Once you settled on a LLC or Corporation, you will most likely decide on the State to register your legal entity. Delaware is the State to register your entity if:

- You live in Delaware

- or, You are looking for institutional money.

Otherwise you might be better off registering in the State you live in and the operations of your business are conducted. If you register in Delaware but your offices are in California, you will still need to register with California State, filing tax returns and paying Franchise Tax in both Delaware and California.

It is important to note here is that you can usually convert an LLC to a Corporation tax-free within the same State but not across States.

More to read

If you are looking for more posts about what it is like to build a boutique subscription product, you might enjoy Hiring a technical co-founder, Mental Preparation for the Future CEO or A typical day building a boutique hosting platform

More business lessons we learned running a SaaS application hosting platform are also available on the DjaoDjin blog. For our fellow engineers, there are in-depth technical posts available.