Sofware-as-a-Service Business Metrics

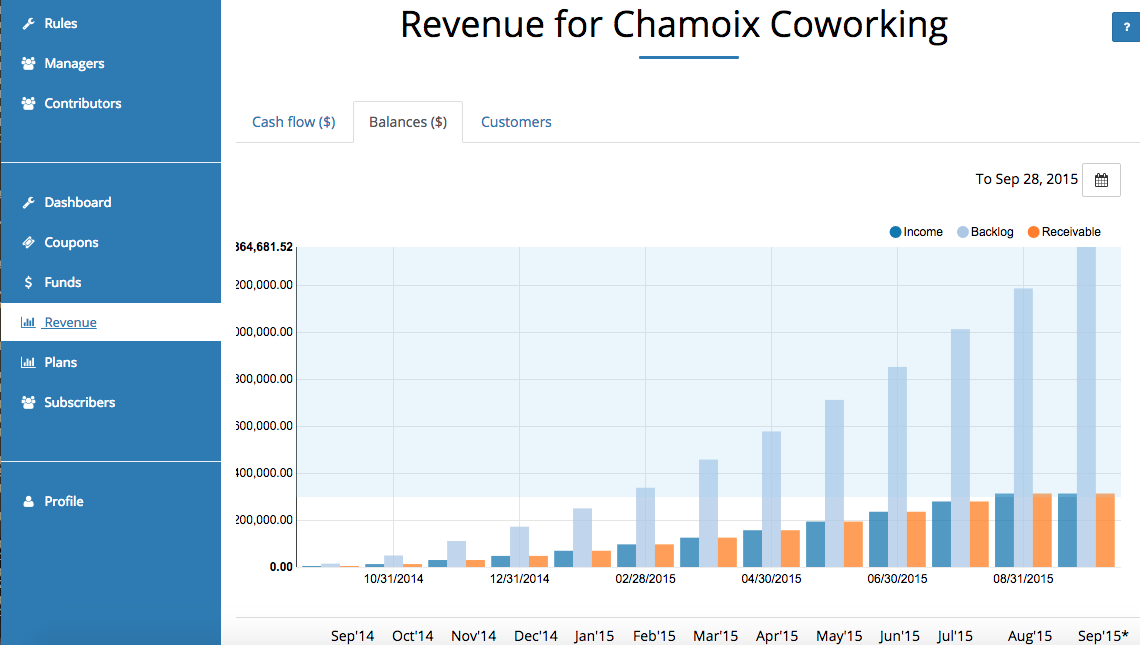

When you deliver Software -as-a-Service, service accounting rules apply. Revenue is recognized over the life time of the contract. Three rows on the balance sheet are thus important to keep track of

Income At the end of each period, the income generated by the service during the period must be recognized. For example, on a $828 for a one-year contract we will recognize $69 every month from the start date.

Backlog The accounting rules dictate to recognize the value over the lifetime of the contract but it does not make any requirements as to when cash is transferred between the subscriber and the provider. Backlog is the value of the contract that has been paid by the subscriber in advance of the service being delivered.

Receivable A receivable, or accounts receivable, is the amount to be paid for orders placed. A receivable is effectively a credit and recorded as a receivable at the time of the order. When the order is paid, receivables are reduced accordingly and cash assets are credited.

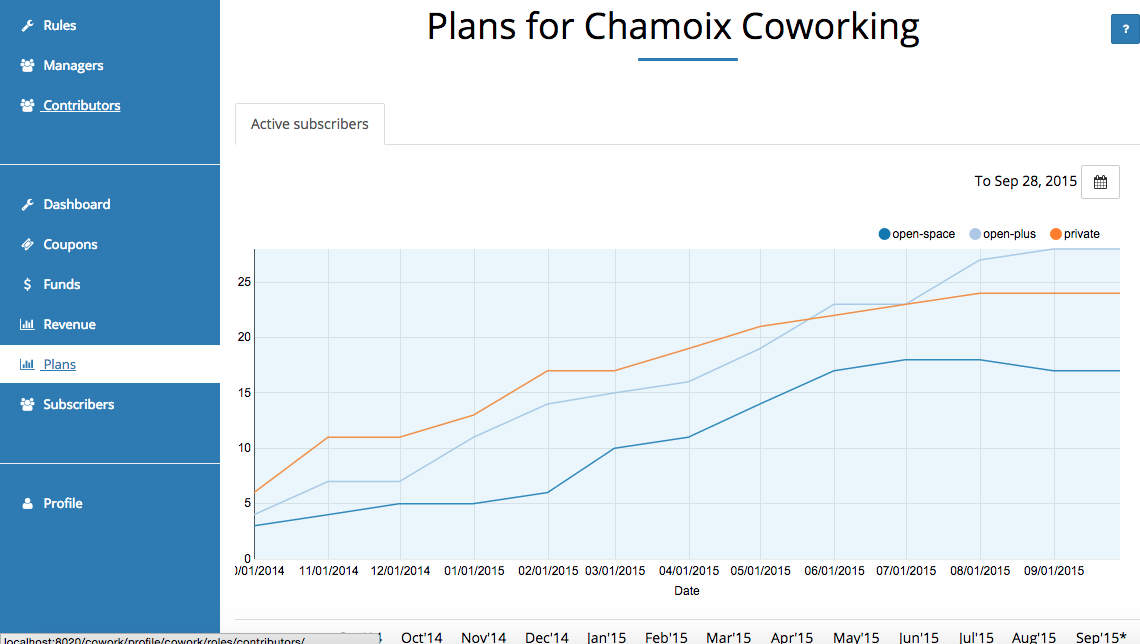

Of course, you will want to also keep an eye on the lifetime value of a subscriber, churn rate and the popularity of each plan. These metrics are automatically generated in real-time from the activity happening on your DjaoDjin-hosted site.

Total Sales This number reflects the total amount ($) ordered by customers in the period, regardless if the associated charges were successful or not.

New Sales This number reflects the amount ($) ordered by customers in the period that did not order anything in the previous period. It includes new customers that registered and ordered subscriptions in the period as well as past customers that had cancelled previously and are signing on again. By definition, New Sales is always lower than Total Sales.

Churned Sales This number reflects the amount ($) the business could have expected to see as renewals but that did not happen because of subscription running out and not being renewed or active cancellation.

Payments This number reflects the amount ($) that was sucessfuly charged to customers in the period.

Refunds This number reflects the amount ($) that was returned to customers in the period, usually by the business support staff after interacting with a customer.

- Need help?

- Contact us

- Curious how it is built?

- Visit us on GitHub